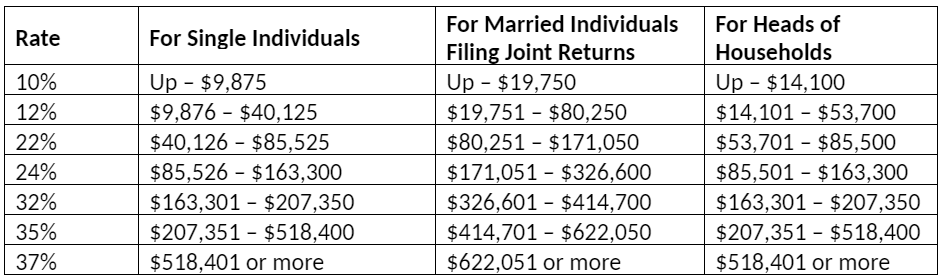

The federal Canada Employment Amount (CEA) has been indexed to $1,3. The federal income tax thresholds have been indexed for 2023. If the tables are used in these situations, it may result in over or under deduction of federal and provincial taxes during the year. A payment of remuneration, if annualized by the number of pay periods in the cycle, is over the YMPE of $66,600.If at any point during the year, the employee reaches the Year’s Maximum Pensionable Earnings (YMPE) of $66,600 or.However, for the following situations, use the Payroll Deductions Online Calculator (PDOC) for more accurate calculations: You are not required to take any additional steps to include this deduction. The amended tax treatment for CPP additional contributions is imbedded in the tax deduction tables. On March 3, 2022, amendments were made to Subsection 100 (3), paragraph 60 (e.1) of the Income Tax Regulation, ensuring Canada Pension Plan (CPP) additional contributions are treated as a deduction at source. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2023. At the time of publishing, some of these proposed changes were not law. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2023. The major changes made to this guide since the last edition are outlined. Calculate total tax and the tax deduction for the pay period.Step-by-step calculation of tax deductions.

Deducting tax from income not subject to CPP contributions or EI premiums.Additional information about payroll deductions.Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions.Chart 4 – 2023 British Columbia claim codes.Personal tax credits returns (TD1 forms).Canada Pension Plan (CPP) and Employment Insurance (EI).Chart 2 – 2023 British Columbia tax rates and income thresholds.Chart 1 – 2023 federal tax rates and income thresholds.Which provincial or territorial tax table should you use?.What if your pay period is not in this guide?.

0 kommentar(er)

0 kommentar(er)